what percentage of taxes are taken out of paycheck in nc

95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Only the Medicare HI tax is applicable to the remaining four pay periods so the withholding is reduced to 6885 x 145 or 9983.

. Its important to note that there are limits to the pre-tax contribution amounts. Put Your Check in a Bank. What is NC income tax rate 2020.

The income tax brackets have shifted with those making between 38701 and 82500 owing taxes of 445350 plus 22 percent of the amount over 38700. Income taxes FICA and court ordered garnishments NCGS. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in North Carolina.

North Carolina moved to a flat income tax beginning with tax year 2014. And 137700 for 2020Your employer must pay 62 for you that doesnt come out of your pay. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

After a few seconds you will be provided with a full breakdown of the tax you are paying. It is 213 an hour. The IRS recently added a new Withholding Calculator to their website and encourages all employees to use the calculator to perform a quick paycheck checkup.

There is a wage base limit on this tax. The state of North. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance.

This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis. Only the very last 1475 you earned would be taxed at. Social Security Tax.

The Percentage of Taxes Taken out of Paychecks eHow. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing. Published January 21 2022.

Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. 95-258 a 1 - The employer is required to do so by state or federal law. For a single filer the first 9875 you earn is taxed at 10.

Both employers and employees are responsible for payroll taxes. Any wages above 147000 are exempt from the Social Security Tax. Details of the personal income tax rates used in the 2022 North Carolina State Calculator are published.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire. This is divided up so that both employer and employee pay 62 each.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Carolina State Income Tax Rates and Thresholds in 2022. Almost everyone who works for a paycheck has taxes deducted each payday.

For self-employed individuals they have to pay the full percentage themselves. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid. Both employee and employer shares in paying these taxes each paying 765.

For the 2019 tax year the maximum income amount that can be subjected to this tax is 132900. It is 213 an hour. North Carolina Income Taxes.

To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. Newest Checking Account Bonuses and Promotions.

Switch to North Carolina salary calculator. Well do the math for youall you need to do is enter the applicable information on salary federal and. Find out how much youll pay in North Carolina state income taxes given your annual income.

Take Your 2019 Standard Deduction. 95-258 a 2 - The amount of a proposed deduction. For tax year 2021 all.

Social Security tax. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019. This article is part of a larger series on How to Do Payroll.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. What is minimum wage for servers in North Carolina 2009.

For the first 20 pay periods therefore the total FICA tax withholding is equal to or 52670. 1 of 51 Photos in GalleryKruck20 Getty ImagesiStockphoto While payroll taxes are nothing new theyre most likely becoming the source of a newly. I am a server in NC and most of the time I.

Percent of income to taxes About This Answer. Customize using your filing status deductions exemptions and more. For 2022 the limit for 401 k plans is 20500.

Amount taken out of an average biweekly paycheck. Subtract and match 145 of each employees taxable wages until they have earned 200000. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Are Itemized Deductions And Who Claims Them Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

2022 Federal Payroll Tax Rates Abacus Payroll

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How The Tax Burden Has Changed Since 1960

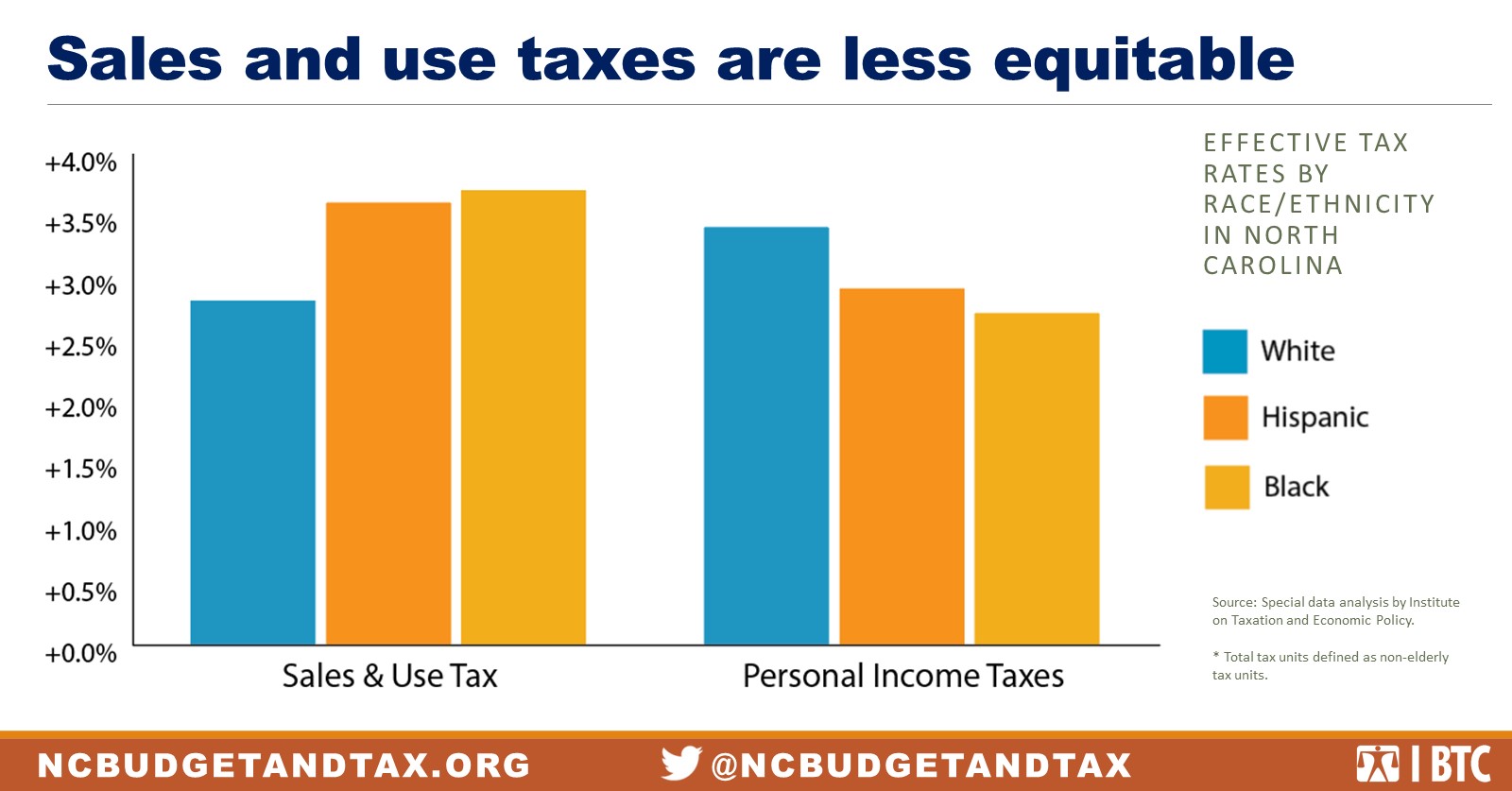

State Tax Policy Is Not Race Neutral North Carolina Justice Center

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina Paycheck Calculator Smartasset

What Is Local Income Tax Types States With Local Income Tax More

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)